FundingShield - Q3 - 2023 - Fraud Analytics With Commentary From FundingShield’s CEO Ike Suri

Q3 2023 REPORT

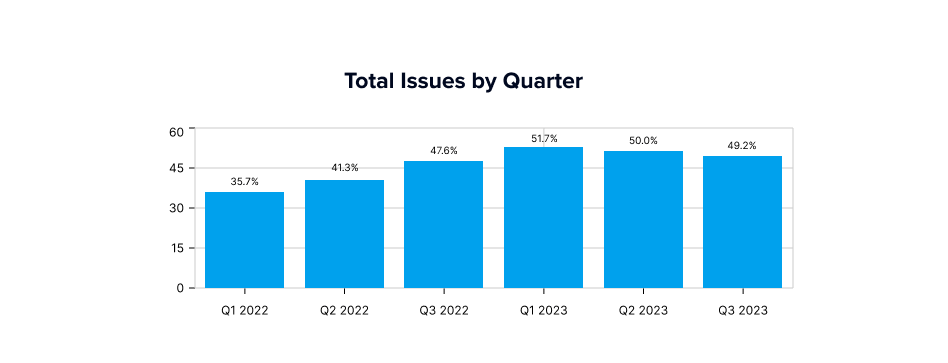

Wire and title fraud remain at alarming highs in 2023. With 49.2% of loans in Q3 2023 having at least one risk issue.

Quarterly Data and Analytics for Q3 2023

During Q3 2023 49.2% of transactions on a $61.3bn portfolio had issues leading to a risk of wire & title fraud. On average, problematic loans had almost 2 issues per loan indicating the lack of appropriate controls by closing agents to identify and fix issues.

- Q3 yielded an all-time high for insurance related issues with 8.9% of transactions having agents with inadequate coverage.

- This is a 62% change compared to Q2, likely driven by more agents failing to maintain sufficient coverage limits.

- Many parties are having issues qualifying for insurance with significant increases in premiums.

- Insurance companies are finding it increasingly difficult to underwrite policies to companies that are subject to high levels of cybersecurity-based threats such as where the loss of significant funds can take place.

- 6.3% of transactions had wire account-related issues, nearly a 3% increase compared to last quarter highlighting ongoing cybersecurity challenges.

- We saw a rise in bank accounts registered to unlicensed 3rd parties who were not associated with the permitted parties to settle funds on a transaction.

- Wire account data transmission security issues and control-related errors at escrow and title companies contributed to the rise in wire-fraud related risk.

Increasing Fraud in the Market

This heightened level of fraud continues to perpetuate while interest rates hit multi-decade highs. Transaction volumes decline as the fed seeks to fight off inflation, but the transactions that close are subject to increased cybersecurity threats and fraud attempts. Ike Suri commented, “Tech innovations that have been deployed by mortgage companies have helped bring down closing costs, however these emerging technologies being introduced such as AI -driven microservices continue to add new vulnerabilities and gaps that can be exploited by threat actors. We expect this trend to continue to rise in the near future.”

This past quarter we continued to identify and protect against several business email compromise events at title & escrow companies. In these events, the fraudsters’ goals are to divert and steal the closing funds by hacking into the title agent’s email accounts and systems. The Federal Bureau of Investigation’s statistics account for reported frauds to the law enforcement agency, however Ike Suri shared, “Many of the risk events are underreported based on our experience identifying, preventing, and remediating issues in real-time.”

Our $5mm per transaction coverage is providing increased value in line with the heightened risk environment. A recent recurring example is lenders that are not receiving final title policies are engaging us for our transaction-level audit trail and certification to help them work with title insurance companies to obtain missing policies. If closing agents become insolvent or go out of business, there is a risk that final title policies aren’t delivered to lenders. Lenders need to obtain such final title policies to deliver loans to the GSEs or investors. With our transaction documentation and assistance, clients have been able to successfully obtain the final title policies from the respective title insurance company. This avoids another risk of financial loss where without such a policy, the loan would have had to been sold at a significant loss or would be ineligible for sale all together.

At the closing session of the recent MBA Compliance & Risk Management Conference, our CEO Ike Suri was questioned - on the impacts of inadequate wire and title fraud pre close reviews. Ike's response highlighted that lack of thorough pre-close reviews leads to higher post-closing trailing document costs and reduced asset quality. - This risk is both internal and external to lender workflows. - Lenders bear the risk of both 3rd - party service providers cutting corners and having gaps in process controls or being subject to data or system (cybersecurity) breaches as well as the same internally. This can result in lenders incurring penalties, audit and investigation costs, time and legal expenses which add up to large dollar amounts. - Ike Suri was a moderator on the closing session which included a diverse group of perspectives with - participants from Planet Home Lending, CMG Financial, Fannie Mae and the Conference Of State Bank Supervisors.