Wire and title fraud risk spiked in the first quarter of this year while closing and settlement firms leveraged new RON, eClosing and other automation technologies and various cyber security breach events took place at a national scale. Prolonged Work-From-Home policies as well as customer convenience demands have driven the need to expand and leverage many of these eClosing technologies which have increased speed but such solutions are not fraud prevention tools.

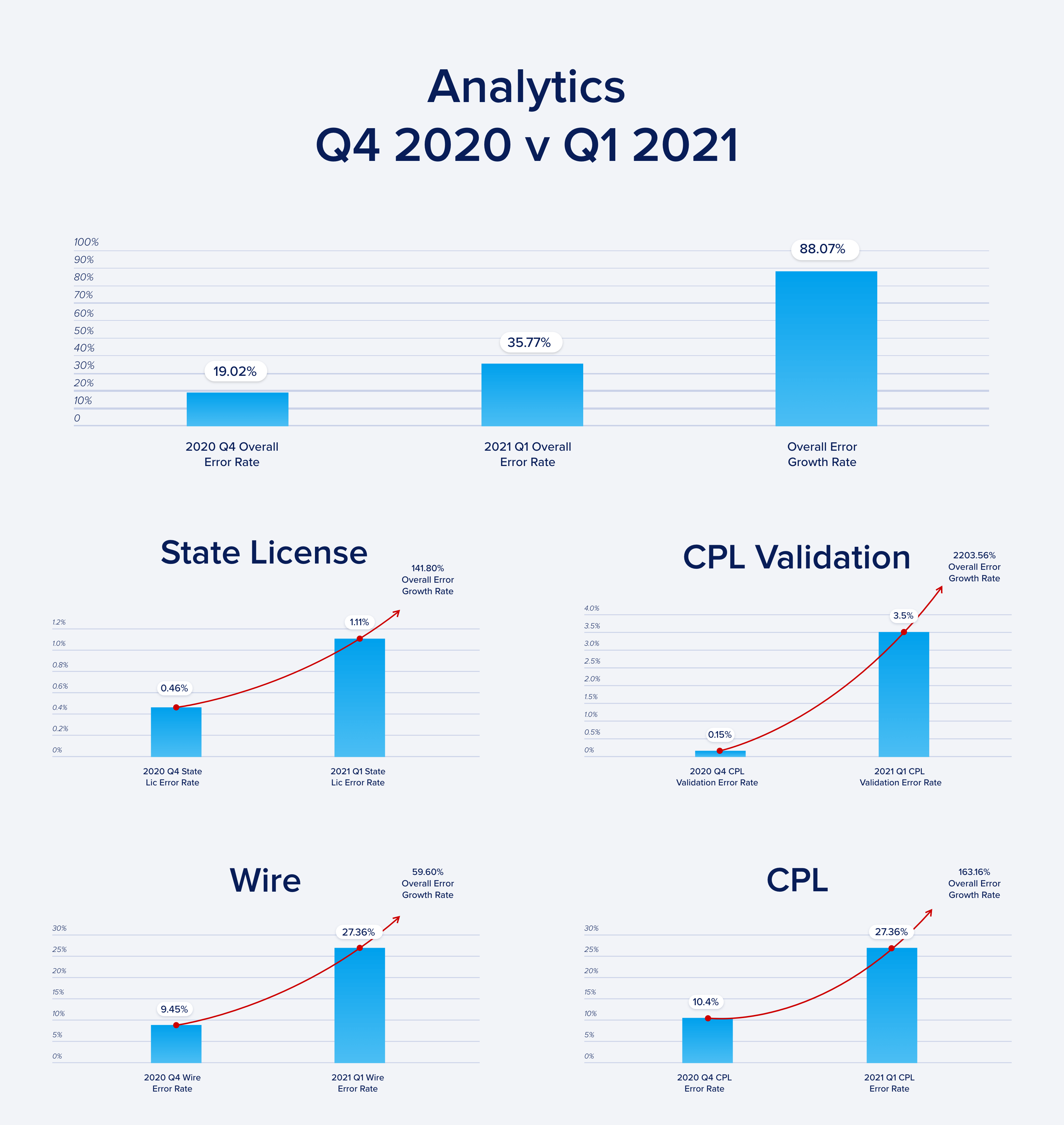

Comparing Q1 2021 vs Q4-2020 there was an alarming increase in fraud/risk exposure surrounding CPL errors/issues of 163%, a 22 times increase in CPL/Agent validation errors with title insurers and nearly 141% increase in state licensing issues. These issues highlight production errors, mis-representations, control issues and inaccurate data being transacted upon that create ideal conditions for fraudsters to prey. FundingShield helps prevent, identify and resolve these inefficiencies, threats and exposures in a timely manner so lenders can run their businesses without interruptions, reputational nightmares and/or losses by working with only valid, verified and vetted closing agents across the country.

Additional Context:

With the rising amount of security breaches, threats to closings from 3rd party cyber and 1st party threats due to breaches in controls or workflows with lenders, title/settlement companies or their real estate partners, the numbers for Q1 2021 reflect an overall rise in the risk of wire & title fraud. The items tracked and observed by FundingShield are a result of our transaction level reviews that go beyond a vendor risk rating or annual risk review of closing agents and their controls which does not uncover transaction level risks and inaccuracies that are the key indicators of fraud. Several lenders in FundingShield’s implementation pipeline had lost funds to fraudsters due to a lack of verifying the elements mentioned in our risk reports. We remind market participants to leverage live data, active transaction level controls and workflow based risk management tools such as FundingShield’s transaction level tools to prevent fraud.