FundingShield Q4 2022 Wire & Title Fraud Analytics

Commentary from FundingShield’s CEO Ike Suri:

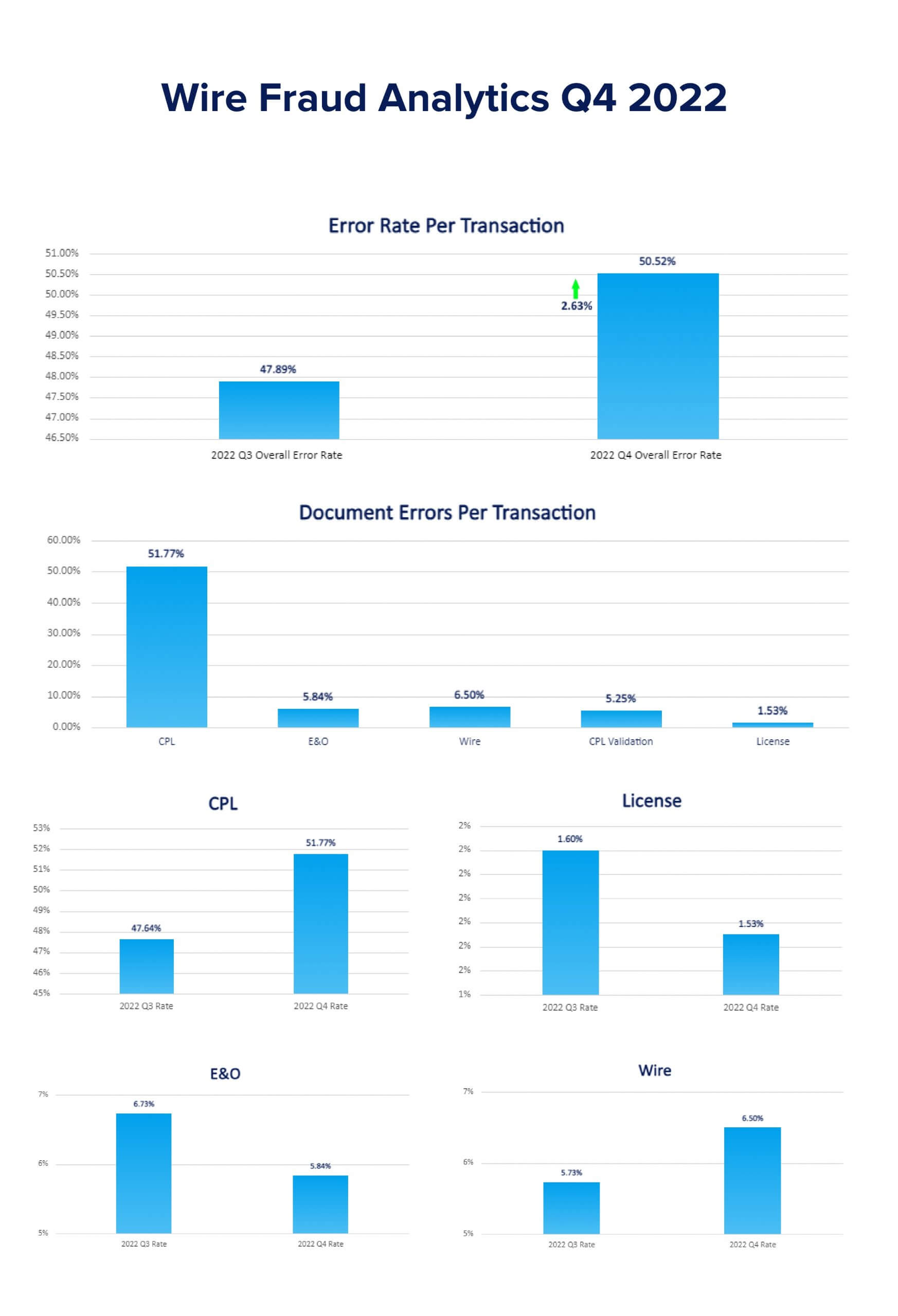

Wire and title fraud risk reached another new record in the fourth quarter of 2022 at 50.5% of transactions having at least one risk issue. With this all-time high percentage of issues, the impact of a single wire or title fraud event could be catastrophic.

Cybersecurity and Cyber Insurance

Insurance costs continue to rise with more acute coverage being offered by insurers that do not capture the wire and title fraud risk. Insurance Insider examined Beazley’s Cyber book and found, “”…US cyber pricing increased 79% in Q2 (2022), compared to 110% in the prior quarter (Q1 2022) and 133% in December 2021.”

Cybersecurity readiness by organizations has generally improved as focus by management and their boards around securing an entity’s internal data, systems and processes are becoming part of the strategy discussion. However the external risk environment is dynamic making it challenging as per a recent Bloomberg Law article, “Cyberattacks are happening so frequently that underwriting standards sometimes can’t match the fast development and sophistication of the hacks. Insurers are raising rates to levels that make it hard for businesses to find affordable coverage.”

External Data and Digitization

Lenders rely upon data from external parties such as digital communication with third-party service providers, customers or other 4th party relationships that are hard to control and monitor in real time. The insurance market has not found an efficient way of managing these risks and thus lenders must proactively protect themselves, which is reflected in our 63% client growth during 2022. This has extended into the eClosing space where FundingShield has delivered top 10 lenders requests to vet closing agents ÔÇÿpermissions to issue title, settle funds, provide eClosing, RON and other digital closing solutions in real time. Fundingshield is being integrated to ensure the digital products speed and ease improvements do not result in increased risk of fraud.

Verification and prevention versus data review

As wire fraud has become a risk priority for lenders and real estate market participants, we see many vendors offering confirmation of unverified data as a solution. The use of static-data, unverified data does not prevent the fraud from taking place thus the process, data source and verification procedures of a risk management solution need to be fully understood to make an informed risk management process and procedure. FundingShield has procedures and controls to assure verification of real-time source data to prevent these attacks from being successful that have been used on over $2.5 Trillion in closings.

Quarterly Data

During Q4-2022 overall 50.5% percent of transactions had issues leading to wire & title fraud risk and 5.25% of transactions were not registered or valid in title insurer systems at time of closing.

Further there was a 13% increase in wire instructions issues and a 8.7% increase in CPL errors during Q4 off of all high time highs in these categories. We saw client growth of 63% during 2022 as lenders managed resized organizations, saw an increase in fraud risk, and had a desire to convert to variable cost structures due to dynamic transaction volumes. Our $5mm per transaction coverage, the only offering of its type in the market, is a key driver to growth as this is incredibly valuable in the current high-risk environment.

Analytics Q4 2022 v Q3 2022:

- 8.7% increase in CPL related errors

- 5.25% of transactions had CPL / agent validation related errors with title insurer systems, a new all time high.

- 6% of agents had insufficient insurance coverage, near flat to last quarter

- 1.6% of agents were unlicensed, near flat to last quarter

Additional Context:

These issues highlight production errors, mis-representations, control issues, cyber-attacks and business email compromise events that create ideal conditions for fraudsters to prey. FundingShield helps prevent, identify and resolve these inefficiencies, threats and exposures in a timely manner so lenders can run their businesses without interruptions, reputational nightmares and/or losses by working with only valid, verified and vetted closing agents across the country.