FundingShield 2020 Holiday Season

Wire & Title Fraud Analytics

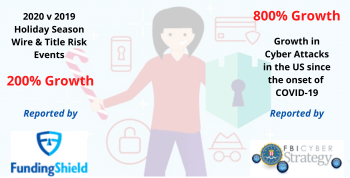

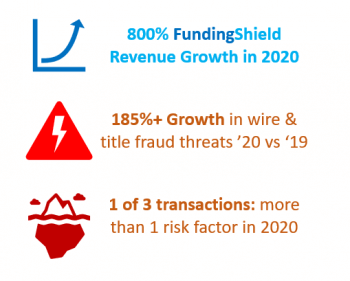

FundingShield analytics show wire & title fraud threats have spiked at over 200% when comparing the 2019 to the 2020 holiday season.

Further the broader cyber-risk beyond the mortgage industry shows fraud and risk has spiked by over an 800% increase in cyber-attacks with nearly 4000 attacks a day being reported since the onset of Covid-19 to the FBI’s Internet Crime Complaint Center “IC3” and cybercrime units.

Ike Suri shared, “Work From Home will remain the norm irrespective of containment and vaccinations, this digital transformation becoming the norm will present continued challenges for CEOs, security teams and firms on how to secure their business models in 2021 and beyond. Adopting Zero trust network access protocols for data and technology will be required alongside ÔÇÿ100% trust but verify’ protocols for human based interactions and workflows.”

With a COVID-19 vaccination plan and 2021 in site, market participants must plan for the new year by remaining vigilant, prepared and equipped with fraud prevention tools.

Fannie Mae’s, Staphanie Derdouri (Sr. Director Information Security Risk) shared in Cyber Security Hub’s article Cyber Security: What is the First Thing To Do In 2021 a simple message “Engage Immediate Security Awareness. You have to make sure people are ready and listening.”

FundingShield’s tools have seen over 800% revenue growth as a trusted and dynamic response to the growing threats in the mortgage and real estate market.

FundingShield’s tools have seen over 800% revenue growth as a trusted and dynamic response to the growing threats in the mortgage and real estate market.